Alta-led Research on “What’s Hot” in Equipment Markets Now Available

March 13, 2024

For the 11th year in a row, construction equipment dominated the field of 15 equipment categories ranked in the Equipment Leasing & Finance Association’s “What’s Hot/What’s Not” Equipment Market Forecast for 2024. This year’s survey also found that equipment finance companies have become less optimistic about all types of equipment, due to rising interest rates, increased regulation and a slowing economy.

2024 marks the 34th year the ELFA has published the “What’s Hot/What’s Not” equipment market forecast. For all of those years, the research has been led by Carl Chrappa, a senior managing director with Alta who leads the advisory’s Asset Management Practice.

While four of the top five top lessor equipment rankings were identical to last year’s, Chrappa notes in the report that transportation dropped from the third spot in 2023 to a tie for 12th in 2024. He said this reflects the second-largest collapse in the survey’s history.

The report details the following overall ranking of equipment types for portfolio preference among ELFA members. These rankings are based on the amount of future financing volume (unweighted) and the best and least favorable future equipment leasing and financing opportunities (weighted).

- Construction

- Machine Tools

- Medical

- Hi-tech/Computers

- Marine/Intercoastal

- Rail

- Aircraft

- Tie: Oil/Gas/Energy, Plastics

- Containers/Chassis

- Automobiles

- Tie: Telecom, Trucks/Trailers

- FF&E

- Printing

The full report is available at the ELFA Knowledge Hub. Chrappa said it’s become the most widely requested report from the ELFA. In the document, Chrappa offers detailed information on growth rates, secondary markets and other intelligence impacting each of the 15 equipment market categories surveyed.

“It’s a helpful tool for planning, and for portfolio managers, it covers just about everything you need to know for the year,”

Carl Chrappa, Senior Managing Director

The report is the product of three solid months of research. The 2024 document includes four bonus questions that offer insight into ELFA members’ sentiments about the economy.

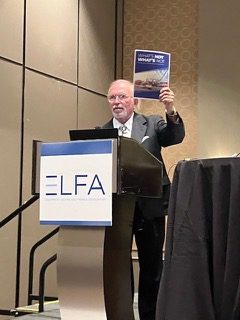

Chrappa co-presented the report’s findings with Gregory Chrappa, managing director with Alta’s Asset Management Practice, at the ELFA Equipment Management Conference March 11 in New Orleans. Carl Chrappa has five decades of hands-on equipment valuation, inspection and remarketing experience. He has built a reputation as an internationally recognized expert and speaker in the field of asset management. He is a founding member and chair emeritus of the ELFA’s Equipment Management Committee. He is also a member of the Federal Reserve Bank of Philadelphia’s “Livingston Report” Macroeconomic Survey panel.

All of this expertise helps inform the work The Alta Group does on behalf of clients within its Asset Management Practice. The practice provides hands-on advisory expertise throughout the life of equipment, partnering with clients to deliver services including:

- Equipment management strategies.

- Circular economy equipment considerations and capacity building.

- Inspections.

- Certified appraisals.

- Portfolio management.

- Residual risk analysis.

- End-of-lease consulting.

- Certified valuations.

- Redeployment and remarketing.

Get Alta Insights,

written by our advisors delivered to your inbox.

By submitting this form, you are consenting to receive marketing emails from: The Alta Group. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact