Alta-authored ELFF report offers a roadmap to seizing climate finance opportunity

April 4, 2024

Climate finance presents an unprecedented market opportunity for the equipment finance industry, as the global energy transition drives a tremendous movement of capital, significant changes in policy and the deployment of new technologies to address climate change. The combination of massive amounts of capital, rapidly changing global policies and new and untested technologies means that seizing the market-entry opportunity presented by climate finance requires careful planning and strategy.

The Equipment Leasing & Finance Foundation recognized that the industry needed a roadmap to the enormous market-entry opportunity in climate finance, and contracted The Alta Group to produce a comprehensive research report to offer insights on how equipment finance companies can take advantage.

The report, “Climate Finance: A Massive Commercial Opportunity for Equipment Finance,” is available now on the Foundation’s website. The report comprises a wide compilation of available market data, a survey of members of the Equipment Leasing & Finance Association’s Climate Finance Working Group and in-depth interviews with participants in climate finance from across the industry.

“This study aims to accelerate the equipment finance industry’s understanding of climate finance, and offers a roadmap for equipment finance companies to develop their own strategic and tactical plans toward successfully participating in this market,” said Alta Co-CEO Valerie L. Gerard, who is chair of the Foundation’s research committee.

“This study aims to accelerate the equipment finance industry’s understanding of climate finance, and offers a roadmap for equipment finance companies to develop their own strategic and tactical plans toward successfully participating in this market.” Valerie L. Gerard, Co-CEO at Alta

An Enormous Opportunity

The report emphasizes that the sheer amount of capital investment poised to pour into climate finance makes it a difficult market to ignore. Climate and emissions targets on the books worldwide dictate that the global market opportunity around climate finance is expected to expand significantly through 2050. In the U.S., it is estimated that $27 trillion in capital expenditures across industries is required to hit climate targets by 2050. Globally, investment in climate finance is currently at $1.2 trillion annually and is expected to grow to $9 trillion by the year 2030.

As Alta Co-CEO Jim Jackson points out in the report’s preface, seizing this opportunity requires new approaches to mitigating risk, managing assets, underwriting transactions and more—and it may not be for everyone. However, “Those who are willing to understand the opportunities and risks associated with climate finance and determine the best course of action to mitigate those risks through a well-defined strategic and tactical approach to the industry will be well positioned to take advantage of this significant market,” Jackson writes.

Understanding Climate Finance

Climate finance includes investments from both governments and private enterprises to finance activities that mitigate or adapt to the impact of climate change. Specifically for the equipment finance industry, the focus is on financing assets and solutions intended to lower or neutralize carbon emissions. Primary areas for investment include:

- Renewable energy generation, storage and distribution.

- Infrastructure development.

- Energy efficiency and utilization.

- Technologies for capturing carbon emissions.

- E-mobility

The ELFF report examines current equipment finance participation across climate finance sectors including solar energy, energy efficiency, electric vehicles, battery storage and the emerging market of clean hydrogen.

The authors examine special considerations necessary to entering the climate finance market. These include circularity, asset life extension, the potential for technology and data to contribute to inputs management, as well as risk management considerations and global and domestic political risks, including the role of tax incentives and regulations in making these massive capital investments feasible. A discussion of funding trends includes conventional capital markets funding, as well as the rapidly expanding carbon credits market.

A Comprehensive View

The ELFF climate finance study offers a real-world view of how this market opportunity is unfolding across the equipment finance industry. The study’s authors conducted an online survey of a targeted group including members of the ELFA Climate Finance Working Group. This group was created in late 2022 to provide education and best practice sharing, networking, and advocacy work. In addition, the authors conducted in-depth interviews with individuals from 15 organizations across the climate finance ecosystem, from bank-owned and independent equipment leasing companies, debt and equity capital providers, captive finance companies, and service providers, including law firms and valuation services.

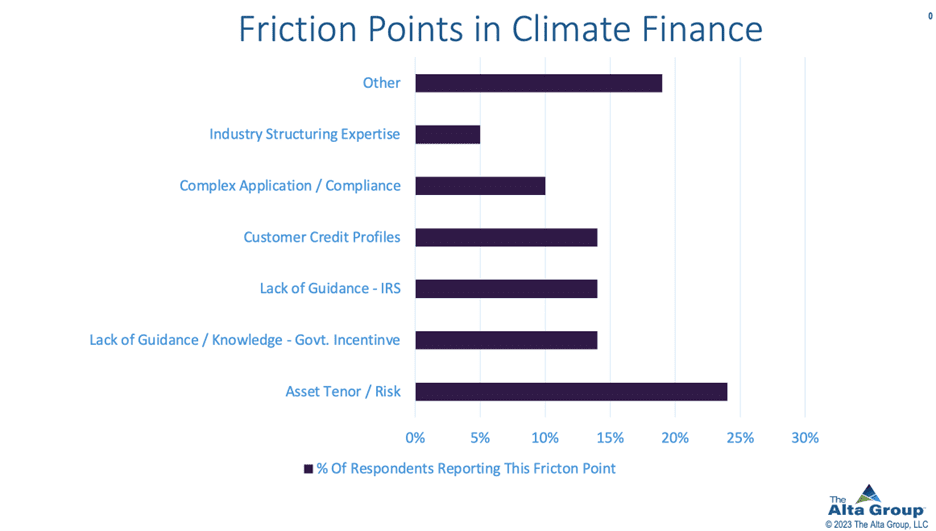

The research reveals not only the immense business opportunities that exist, but also the most common friction points that will have to be navigated as these new markets mature. The study offers a roadmap to developing a climate finance plan that can help teams think through these various challenges, a sampling of which are listed in the chart below.

Expertise in an Emerging Market

The ELFF’s climate finance research report is authored by a team of four equipment finance professionals, three of whom are from The Alta Group. The team reflects the breadth of global experience and knowledge that Alta brings to this important developing market entry opportunity.

|

Patricia Voorhees, with 25 years of experience across commercial finance sectors, advises clients on strategy, M&A, climate finance/energy transition strategy and funding and vendor/captive programs. She chairs the Equipment Leasing & Finance Association’s Climate Finance Working Group. |

|

Ian Robertson, executive director for Invigors, which is part of The Alta Group, has more than 20 years of experience within the global equipment finance market, and has been increasingly called upon to advise clients on their approach to the energy transition as well as sustainability, and circular business models. |

Robertson and Voorhees co-authored a three-part series in Equipment Finance Advisor last year that offers a guide to planning climate finance strategy.

|

Rafael Castillo, CEO for The Alta Group’s Latin America and Emerging Markets division, is an international attorney with expertise in asset-based financing and multinational investments, and offers market-entry expertise on climate finance and nearshoring, a topic he wrote about last year in the Monitor. |

Joining the Alta authors on the ELFF report is Razi Amin, a founding member of the ELFA Climate Finance Working Group who has more than 30 years of leadership experience in building and managing teams in asset-backed and asset-based debt, including portfolio management experience at major global financial institutions including JPMorgan, Bank of America, Credit Suisse, BNP Paribas Mizuho, IFC and the World Bank.

The Alta Group stands ready to assist clients in implementing climate finance market-entry strategies rooted in best practices. Our advisors are closely watching the rapid developments in global public policy and emerging technology that are driving this evolving market.

Get Alta Insights,

written by our advisors delivered to your inbox.

By submitting this form, you are consenting to receive marketing emails from: The Alta Group. You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact